SIP Calculator

SIP or Systematic Investment Plan is an investment option that is offered by Mutual fund companies. One can invest little amount by utilizing SIP periodically ( monthly, quarterly and Yearly). Besides, it offers a very controlled approach to investing for the retail investors. This, in succession, creates a positive approach to investing for creating wealth in the long term. If you are willing to calculate your SIP, you always have the option of using an SIP calculator. An SIP calculator helps you calculate your anticipated returns and wealth gain.

An SIP is capable of making you financially disciplined as well as instil the habit of saving. It is always said the more in advance, the better and the same logic is applied when you invest in a SIP. The SIP calculator helps you to know more about the assets you own and also how you can invest your money in mutual funds.

An crucial factor which makes an SIP a intelligent choice of investment is because of mechanisation. Such as, if you have started an SIP of 1,000 INR in a mutual fund, this amount will get deducted from your bank account and will get invested in a mutual fund of your own choice regularly, every month, on a pre decided date.

SIP Calculation Formula

If you put the SIP formula FV = P × ((1 + i)n - 1) / i) × (1 + i) correctly the result will be more and more effective, with SIP formula, you can calculate the SIP return.

FV = P × ((1 + i)n - 1) / i) × (1 + i)

Where:

FV = Future value

P = Amount invested at the start of every payment interval

n = Number of payments

i = Periodic interest rate

r = Expected Annual Returns (P.A %)

Suppose you want to invest 1000 thousand

Per month for 5 years and the rate of interest is 12% than the amount you get on

Maturity will be 82486 (Approx).

Q: How to Calculate SIP Manually?

Ans: For a person who invests regularly, SIP calculations is an important yet a little complex part of it. The SIP investments are investments that happen on a regular interval (usually pre decided dates) and are very well planned. At the start of making the investment, one gets the units which are prefixed according to the NAV value of the selected scheme during the time of investment. A time goes, many of these units accumulate and it gets difficult to figure out the exact value of money that one has acquired or earned over this period of time, reason being that every instalment would have evolved differently.

To make things easier, the only thing you need to do is to go to your computer while having a basic knowledge of excellNSE- 2.16% programme and calculate the returns of all the investments you have made. A formula that comes in handy while calculating the returns on your investments will be XIRR.

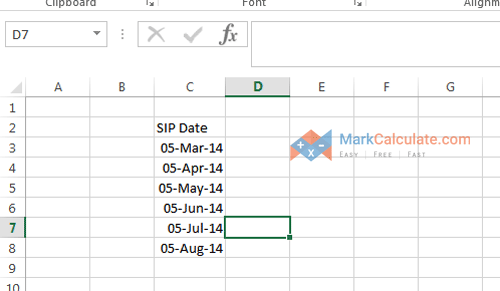

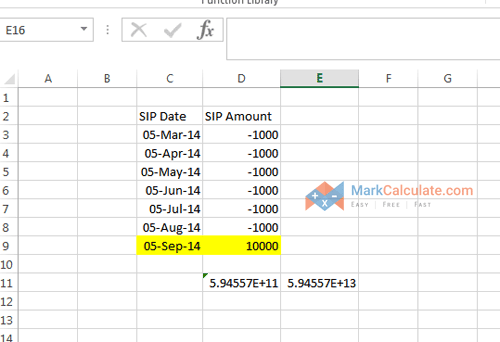

STEP 1

Once you open the excel file, type in all the dates of the SIP in one single column.

For eg: if you made your first investment in March 2014 and from that date onwards, the instalment is due on every 5th of the month. Mention that date in one column in your excel sheet.

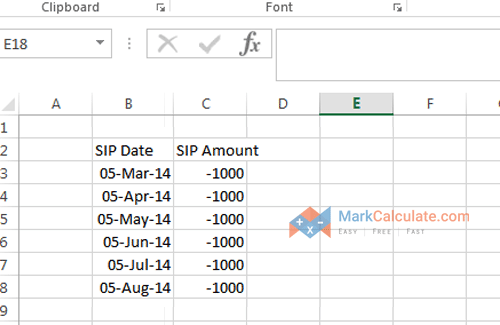

STEP 2

After the step 1, one is to enter the amount that you have invested in the SIP in the column next to it. Assuming that you are investing 1000 INR in it every month, all you have to do is to enter this amount with (-) minus prefix to this. This sign is important as it will define the cash flow.

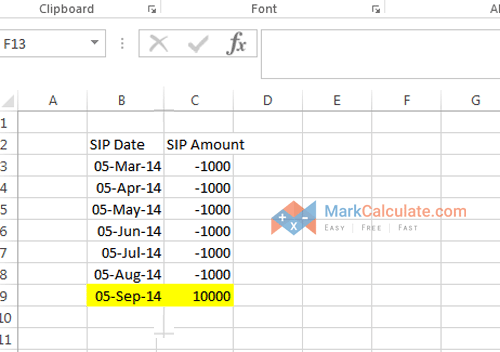

STEP 3

After these steps it is now time to enter the total market value of all the units owned by you. All you need to do is enter the date for whose returns you want to check along with its market value of every unit in the scheme. These are to be entered in the same scheme where you have previously entered the SIP dare and the amount.

You can check the market value of the units by logging into your SIP account and by going through your statement. The market value of units is not to be prefixed with the minus sign (-) as this is the inflow and not outflow of cash.

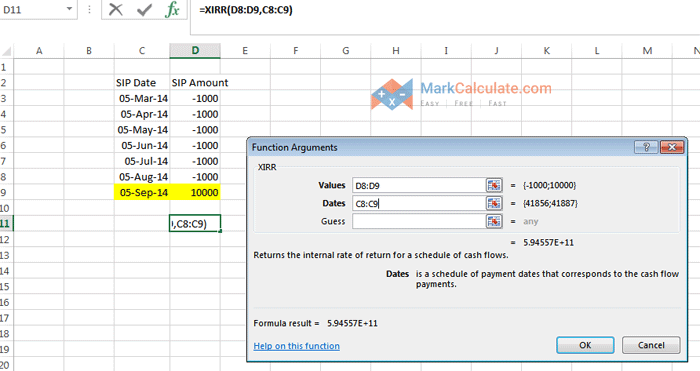

STEP 4

After all these above mentioned steps, it is now time to use the XIRR function which can be found by moving the cursor to the blank cell next to the current one and then open the XIRR.

The following options will be prompted viz., to be filled- dates guess and values.

- Select the cell having SIP amount along with the market value for entering the value field.

- So as to fill the date’s option, one must select the cells having the return date and SIP dates.

- The guess option can be left blank and press OK.

STEP 5

Now comes the final step, all you need to do is multiply the decimal number available 100. The result which is shown would show the return amount earned for the there stated SIP investment on the date that you want.

This is one of the easiest ways out of many to calculate your returns manually.

Q: What is SIP Calculator?

Ans: An SIP calculator helps us to arrive at the maturity or the estimated maturity amount receivable from a small regular investment made over a given period of time.

Q: How does SIP Calculator work?

Ans: A SIP calculator works by the values which are entered by the users. The users are to enter their amount of investment, recurrence of investment,

time period of the investment, and the anticipated returns. The SIP calculator is based on the compound interest formula. The compounded interest powers the mutual fund returns. Clear Tax SIP Calculator shows the differentiation of the returns offered by mutual funds with fixed deposits.

Q: What is SIP?

Ans: Systematic investment plans (SIPs) is one of the two ways of investing in mutual funds. SIPs allow the investors to invest a considerably small sum on a weekly, monthly, quarterly, bi-annually, or annual basis. An Investor can choose the frequency of his investment, and the fund house has no say in this. Furthermore, investors are to be given the complete liberty to initiate or terminate their SIPs.

Q: What is use of Systematic Investment Plan (SIP)?

Ans: The use of SIP calculator is becoming the need of the hour as most of us very busy in our lives. To use SIP will lead you to have a proper and most effective way how you make an investment.

For example, like every drop of water is as important as breathing in our life because it makes an ocean, by using SIP your small investment could go a long way in making wealth over a period of time.

Systematic investment plan (SIP) is used in making investment in a fixed sum, also in a mutual fund scheme, it allows you or an investor to buy units regularly of a particular date of the month.

Q: How to cancel SIPs?

Ans: SIPs could be terminated online or you can do so by contacting the agent or fund house directly.

Q: What is the average return on an SIP?

Ans: The average return on an SIP usually depends on multiple factors including the type of mutual fund invested in, the tenure of the investment, the amount of SIP and the prevailing rate of inflation. For example, you invest in large cap-equity mutual fund where the return is around 12-18%.

Q: How long should I invest in SIP?

Ans: The sip calculator helps determining the investment amount after which, the completion of the investment tenure will help in the fulfilling of the life goal for which one started the investment.

Q: What is the least rate of return in SIP?

Ans: The returns of SIP investments are depended upon the mutual fund and also the prevailing market conditions at the time of discharging the investment made. Also, the investors are allowed to either increase or decrease their SIP amount.

Q: What is Advantages of Systematic Investment Plan (SIP)?

-

With the help of SIP, you can make investments with a proper plan as the name of the plan is a systematic investment plan. If you are planning to make an investment, SIP Calculator help to calculate the investment amount to meet the goals.

-

If you have made an investment via SIP, you do not require to speculate on timing the market. If you invested in the stock market with the help of SIP you do not need to worry about the volatility of the market as you may have witnessed the volatility regularly.

-

One of the biggest advantages it has, it is very flexible you can update/ cancel and also create SIP anytime. Most of the SIP investments start from five hundred to one thousand rupees.

-

This calculator also plans and ensures that your savings is as per the financial needs and requirements. You can also invest in Mutual Funds as it is a modern day's requirement.

Disclaimer

While every effort has been done in developing this calculator, we are not accountable for any incidental or consequential damages arising from

the use of the calculator tools on our web site. These tools serve to visitors as a free calculator tool. Please use at your own risk.

The calculations provided are just a guide. You are advised to speak to a professional financial advisor before taking any financial decision.