The role of calculators is becoming a fashion and also it is the need of the hour. Today life is very fast and around you, you must have noticed that, people saying I don't have time. So to solve this problem, using calculators is the better option than anything else. In this blog, you will get to know about Emi calculator, how you can calculate your EMI with the help of Emi calculator, what is the need of the calculator. Mostly, banks are using these types of calculators, so that they can calculate EMI properly.

What is EMI Calculator?

EMI stands for Equated Monthly Installment. If you take a loan from a bank you will have to pay the money monthly. It is the amount that you have to pay to the financial institution or bank by the amount you have taken from a bank or other financial institution fully paid off. The amount that is calculated or EMI calculation machine, that is called an EMI calculator.

EMI calculation is done properly or you can say 100%corectely that is calculated by EMI calculator. The EMI consists of the interest on loan as well as part of the principal sum that has to be repaid. The payment you have taken from a bank, you will have to return bank on a monthly, that all calculated EMI calculator through EMI calculation formula. In the first 2 months you may have to pay a large amount, but, gradually reduces with each payment.

EMI Calculation Formula

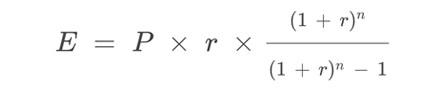

Below is the formula of Emi calculator, and how it does Emi calculation

EMI = [P x r x (1+r)^n]/[(1+r)^n-1]

Where:

E = EMI

P = Principal loan amount

r = Rate of interest or EMI Rate (calculated monthly basis)

We understand this by an example

Suppose you have taken Rs 25000 loan for 12 years, the rate of interest is 8.5% and processing fee is 0.39% than

your monthly EMI will be Rs 246,

So loan amount = Rs 25000

Total interest due = Rs 19313

processing fee = Rs 98, so the total amount payable to the bank will be Rs 44,411(so with the help of an Emi calculation formula we able to get correct results as Emi calculation has to be 100% perfect)

Use of EMI Calculator

Before using Emi calculator all the data or details have to be ready, so once you put all the details in Emi calculator you will get results in seconds. There are many loans we take some time in our lives, like Home loans, car loan, personal loans and education loans. To make Emi Calculation, you need Emi calculator. Before using Emi calculator you need to put some information on it like the loan amount you want to avail, the rate of interest, loan term (months or years). After using Emi calculation formula the result will come in seconds.

Advantages and Disadvantages of EMI

Here is advantages of EMI

-

You have taken an amount from your bank, you cannot return to the bank, so you will have to pay in a small amount to the bank, you can use your amount in some important work.

-

You can make payment to the bank in EMI it will be a benefit for the person who took a loan from a bank. One of the biggest advantages it has no involvement of a middleman, which leads you to save some money at least middleman is taking so much money from you.

-

You can pay the bank in a small amount as most of the time a middle-class family does not have money in their pocket. So overall it gives us many benefits. As a middle-class family or an individual, you do not have a big money with us to buy a car or have our own house or buy a car, so we go to the bank or a financial institution to get a loan.

Disadvantages of EMI

-

EMI rate can cost you a little, but still, this will keep you thinking that you will have to pay money every month otherwise bank people come to you again and again.

-

You will have to pay money to the bank every month, so you will have to save money in the bank. The banks may impose penalties on you in case you delay the payment.

Need For EMI calculator

If you calculate manually it takes to lots of time, so using machines that can give you a correct result with 100% less consuming time it is better to use Emi calculator. So with the help of Emi calculation formula, you can calculate your Emi calculation properly as bank sometime overcharge.

You have to calculate Emi calculation for many Emi like personal loan Emi calculation, car loan Emi calculation, and some other Emi as well, so for better result and also for the perfect Emi rate calculation you need Emi calculator.

Because it relates to finance where even a point (.) can make big differences sometimes so your calculation has to be perfect for that you need Emi calculator. So we can say now today we must need a machine that can calculate perfect and the result should be more than 100% correct so that trust becomes immense.

Conclusion

We can say that today the world is very fast, whatever we do, the result we want that is 100% correct and it should also be less time taking. So with the help of this calculator we can get the result that can be correct. So after using our Emi calculator the result you get is very correct and that will be 100% correct and it will take seconds only.

So use our Emi calculator and enjoy it. While using our Emi calculator you can also have fun, while using our Emi calculator you can ''kill two birds with one stone'' For more information regarding other calculators Click Here

Disclaimer

While every effort has been done in developing this calculator, we are not accountable for any incidental or consequential damages arising from

the use of the calculator tools on our web site. These tools serve to visitors as a free calculator tool. Please use at your own risk.

The calculations provided are just a guide. You are advised to speak to a professional financial advisor before taking any financial decision.