Lumpsum Investment Plan Calculator Online

A lump sum calculator enables you to calculate the maturity value of your investment. Or in simpler language, the lumpsum calculator predicts the future value of your investment that you made today at a particular rate of interest.

EG: if one invests 1 lakh rupees at 15% rate of interest for 60 years, then according to the lump sum calculator, the value of your investments after 60 years would be 43.8 cr.

"My wealth has come from a combination of living in America, some lucky genes, and compound interest."

FORMULA (calculation of mutual funds returns)

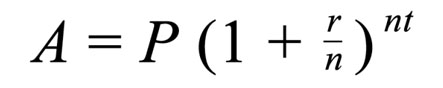

The lump sum calculator of mutual funds computes the estimate return on investment a by using a specific method. It is the compound interest formula, with one of the variables showing the number of times the interest is compounded for a year.

The formula is given as follows:

A = P (1 + r/n)

nt

Here the variable :

A = Stands for the estimated return from the investments

P = Stands for the present value of the investment

r = Rate of Interest

n = The number of compounded interests in a year

t = Duration of investment (Time)

This formula can be used to calculate mutual funds returns accurately.

Example: if you invest 15 lakh in a fund whose return rate is 12% for a period of 5 years, period compounding every 6 months.

The probable return here would be

A = Rs. 15, 00,000 (1 + 12/2) ^ 2/5

This complex equation often goes out of the grasp of the majority of investors. A lump sum mutual fund calculator will calculate your estimated returns instantly. In this scenario, the estimated return you will receive at the end of 5 years will be Rs 26,43,513.

How do these calculators work?

The lump sum calculators are so easy that even a layman can use them. In our lump sum calculator, all you need to do is enter the inputs required to calculate the estimated amount. Inputs such as the amount you will invest, the time period, preferably in years, and how long your investment duration would be. After you enter such required variables, the calculator will give you the estimated value of your investments.

The formula that has been used here in this Lumpsum Calculator is: Value = Investment*(1+R)N

What exactly is a Lump sum Investment?

A Lump sum investment or a one-time investment is an investment in which you invest once (lump sum) and this allows your invested money to generate compounding returns over a given time period.

When should a Lump sum Investment be done?

Any investment (whether it is lump sum or SIP) is to be done by keeping in mind various things like current income of the investor, risk profile, tax constraints, age, liquidity needs, time frame and certain other unique constraints. Lump sum investments are preferred when one has huge amount of surplus funds and more importantly if they think that market will not fall immediately after the investments are made.

What is difference between Lump sum and SIP?

The lump sum investment required one to invest only once whereas; in SIP or Systematic Investment Plan one is to invest a fixed amount periodically. In lump sum investment, the market condition plays a big role as incase, if the market makes a crucial change after your investment, then it is possible that it might take few years to get back to your original investment amount. Whereas, in SIP or systematic investment style one should not be worried about timing the market, as the investment is made during both difficulties of the market. Therefore, the returns generated are weighed as average return.

Disclaimer

While every effort has been done in developing this calculator, we are not accountable for any incidental or consequential damages arising from

the use of the calculator tools on our web site. These tools serve to visitors as a free calculator tool. Please use at your own risk.

The calculations provided are just a guide. You are advised to speak to a professional financial advisor before taking any financial decision.